The Balance Sheet (BS) is the 2nd most common of the "3 Statements", but it may be the most important. Many have called it the "scoresheet" of a business. It totals the assets and liabilities of the business at a certain snapshot in time.

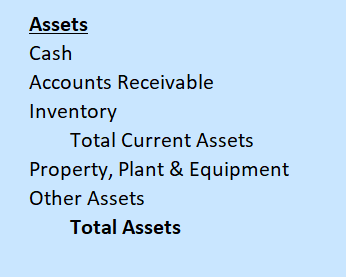

The basic form of a Balance Sheet is below. First the assets:

Detail on the Asset accounts:

Cash: The cash belonging to the business.

Accounts Receivable (AR): The ARs of a business is the total amount of invoices sent to customers which the customers have not yet paid.

Inventory: The amount of inventory belonging to the business. The inventory may be located most anywhere: on warehouse shelves, in trucks (in-transit inventory), raw materials next to a machine waiting to be turned into an end product, or most anywhere else. Ideally, the business should not have excess inventory, since it might be an indicator of projected, but lost, sales for which products were built (and put into the warehouse as inventory), but the sales never materialized.

Total Current Assets: The sum of cash, AR and inventory. Why are these considered "current" assets? Because they are viewed as being temporary...likely to be used up by business operations within a 1 year period. For example, inventory is not expected to be on the warehouse shelf for long since it's expected/hoped that a customer would soon place an order and the inventory would be shipped to fulfill the order.

Property, Plant and Equipment (PPE): PPE are long term (non-current) assets of the business which are expected to be in the business for many years. For example, tables, chairs, vehicles, production machines, would all be examples of PPE.

Other Assets: These are other non-current assets which do not fit "conveniently" into one of the other categories. Other Assets are often $0, especially for a new company founded by an Entrepreneur.

Total Assets: The sum of Total Current Assets, PPE and Other Assets.

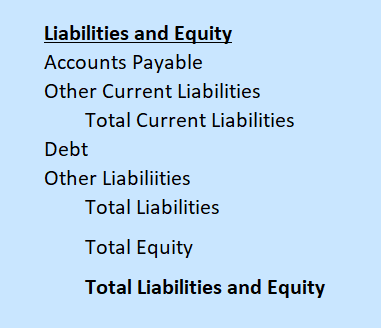

Next the Liabilities and Equity:

Detail on Liability and Equity accounts:

Accounts Payable (AP): The amount of invoices received by, but not paid by, the business. For example, if the business orders a table and receives delivery, then the vendor will present a bill to the business for the amount owed for the table. The bill is added to AP until such time that the bill is paid when it would be removed from AP.

Other Current Liabilities: Amounts owed by the business for which a bill was NOT received, but must be paid by the business within a year. It's considered a current liability because it is expected to be paid within 12 months.

Total Current Liabilities: The sum of AP and Other Current Liabilities.

Debt: Amounts owed which are due over multiple years. The Lender of the debt is often a bank and the debt is typically interest bearing. Namely, the business must pay interest on the outstanding amount of debt owed. New companies typically don't have such debt, because it's not typical that a bank will lend to a new company which does not have any performance history.

Other Liabilities: Long term liabilities (those due over multiple years) which do not fit into other categories on the BS.

Total Liabilities: The sum of Current Liabilities, Debt and Other Liabilities.

Total Equity: This is the total equity held by shareholders of the business. It includes accumulated profits and losses of the business, equity contributions by investors (or founders), net of any cash distributions the business may have made.

IMPORTANT FORMULA: Assets = Liabilities + Equity. This must always be true! It is also the basis for why the Balance Sheet is named Balance Sheet, because it must always "balance". The FORMULA also indicates that Assets - Liabilities = Equity. This is easier to see with an example: if a business has $100 of total assets (in cash), but it owes $90 to various vendors (AP), then after paying the vendors, only $10 remains as the value to the owners of the business (the equity holders, aka the shareholders).

FAQs ==> here